Payment acquirers (credit cards, online payments)¶

Juniper embeds several payment acquirers that allow your customers to pay on their Customer Portals or your eCommerce website. They can pay sales orders, invoices, or subscriptions with recurring payments with their favorite payment methods such as Credit Cards.

Offering several payment methods increases the chances of getting paid in time, or even immediately, as you make it more convenient for your customers to pay with the payment method they prefer and trust.

Note

Juniper apps delegate the handling of sensitive information to the certified payment acquirer so that you don’t ever have to worry about PCI compliance.

This means that no sensitive information (such as credit card numbers) is stored on Juniper servers or Juniper databases hosted elsewhere. Instead, Juniper apps use a unique reference number to the data stored safely in the payment acquirers’ systems.

Supported payment acquirers¶

From an accounting perspective, we can distinguish two types of payment acquirers: the payment acquirers that are third-party services and require you to follow another accounting workflow, and the payments that go directly on the bank account and follow the usual reconciliation workflow.

Online payment acquirers¶

Payment flow from |

||||

|---|---|---|---|---|

Juniper |

✔ |

Full and partial |

||

The acquirer website |

||||

Juniper |

✔ |

Full only |

||

The acquirer website |

||||

The acquirer website |

||||

The acquirer website |

✔ |

|||

The acquirer website |

||||

PayU Latam |

The acquirer website |

|||

PayUMoney |

The acquirer website |

|||

The acquirer website |

||||

The acquirer website |

✔ |

Note

Some of these online payment providers can also be added as bank accounts, but this is not the same process as adding them as payment acquirers. Payment acquirers allow customers to pay online, and bank accounts are added and configured on your Accounting app to do a bank reconciliation, which is an accounting control process.

Bank payments¶

- When selected, Juniper displays your payment information with a payment reference. You have to approve the payment manually once you have received it on your bank account.

- Your customers can sign a SEPA Direct Debit mandate online and get their bank account charged directly.

Additional features¶

Some payment acquirers support additional features for the payment flow. Refer to the table above to check if your payment acquirer supports these features.

Save cards for later¶

If your payment acquirer supports this feature, customers can choose to save their card details as a payment token in Juniper. When they do, they will not have to enter their card details again when making a subsequent payment. This is particularly useful for the eCommerce conversion rate and for subscriptions that use recurring payments.

Enable this feature by navigating to the Configuration tab from your payment acquirer and by ticking the Allow Saving Payment Methods checkbox.

Note

You remain fully PCI-compliant when you enable this feature because Juniper does not store the card details directly. Instead, it creates a payment token that only holds a reference to the card details stored on the payment acquirer’s server.

Manual capture¶

If your payment acquirer supports this feature, you can authorize and capture payments in two steps instead of one. When you authorize a payment, the funds are reserved on the customer’s payment method but they are not immediately charged. The charge is only made when you manually capture the payment later on. You can also void the authorization to release the reserved funds; this is equivalent to a regular cancellation. Capturing payments manually can prove itself useful in many situations:

Receive the payment confirmation and wait until the order is shipped to capture the payment.

Review and verify that orders are legitimate before the payment is completed and the fulfillment process starts.

Avoid potentially high processing fees for cancelled payments: payment acquirers will not charge you for voiding an authorization.

Hold a security deposit to return later, minus any deductions (e.g., after a damage).

Enable this feature by navigating to the Configuration tab from your payment acquirer and by ticking the Capture Amount Manually checkbox.

To capture the payment after it was authorized, go to the related sales order or invoice and click on the CAPTURE TRANSACTION button. To release the funds, click on the VOID TRANSACTION button.

Note

Some payment acquirers support capturing only part of the authorized amount. The remaining amount can then be either captured or voided. These acquirers have the value Full and partial in the table above. The acquirers that only support capturing or voiding the full amount have the value Full only.

The funds are likely not reserved forever. After a certain time, they may be automatically released back to the customer’s payment method. Refer to your payment acquirer’s documentation for the exact reservation duration.

Juniper does not support this feature for all payment acquirers but some allow the manual capture from their website interface.

Refunds¶

If your payment acquirer supports this feature, you can refund payments directly from Juniper. It does not need to be enabled first. To refund a customer payment, navigate to it and click on the REFUND button.

Note

Some payment acquirers support refunding only part of the amount. The remaining amount can then optionally be refunded too. These acquirers have the value Full and partial in the table above. The acquirers that only support refunding the full amount have the value Full only.

Juniper does not support this feature for all payment acquirers but some allow to refund payments from their website interface.

Configuration¶

Note

Each acquirer has its specific configuration flow, depending on which feature is available.

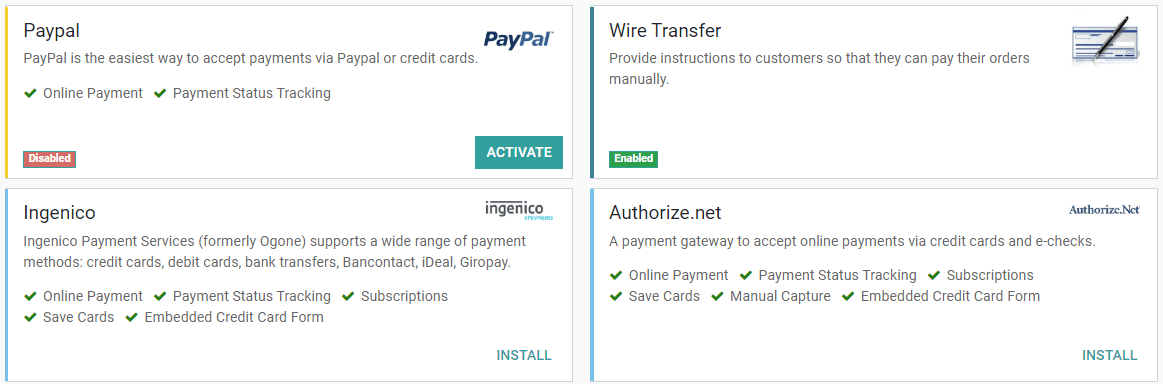

Add a new payment acquirer¶

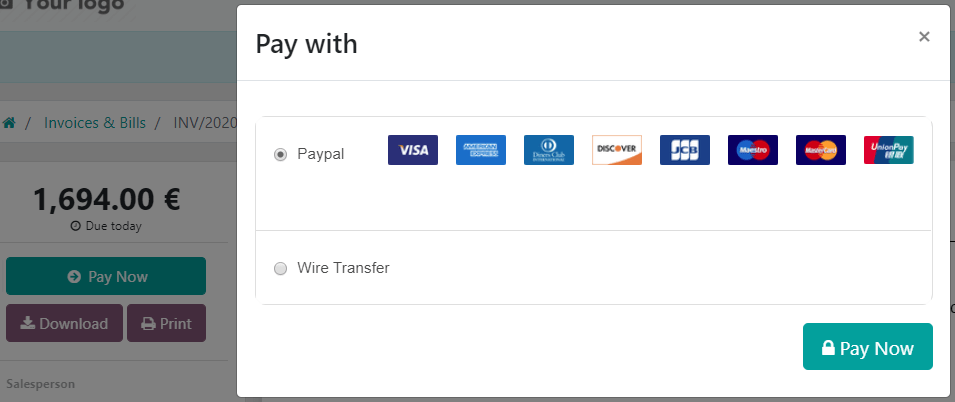

To add a new payment acquirer and make it available to your customers, go to , look for your payment acquirer, install the related module, and activate it. To do so, open the payment acquirer and change its state from Disabled to Enabled.

Warning

We recommend using the Test Mode on a duplicated database or a test database. The Test Mode is meant to be used with your test/sandbox credentials, but Juniper generates Sales Orders and Invoices as usual. It isn’t always possible to cancel an invoice, and this could create some issues with your invoices numbering if you were to test your payment acquirers on your main database.

Credentials tab¶

If not done yet, go to the online payment provider website, create an account, and make sure to have the credentials required for third-party use. Juniper requires these credentials to communicate with the payment acquirer.

The form in this section is specific to the payment acquirer you are configuring. Please refer to the related documentation for more information.

Configuration tab¶

You can change the payment acquirer’s front-end appearance by modifying its name under the Displayed as field and which credit card icons to display under the Supported Payment Icons field.

Countries¶

Restrict the use of the payment acquirer to a selection of countries. Leave this field blank to make the payment acquirer available to all countries.

Payment journal¶

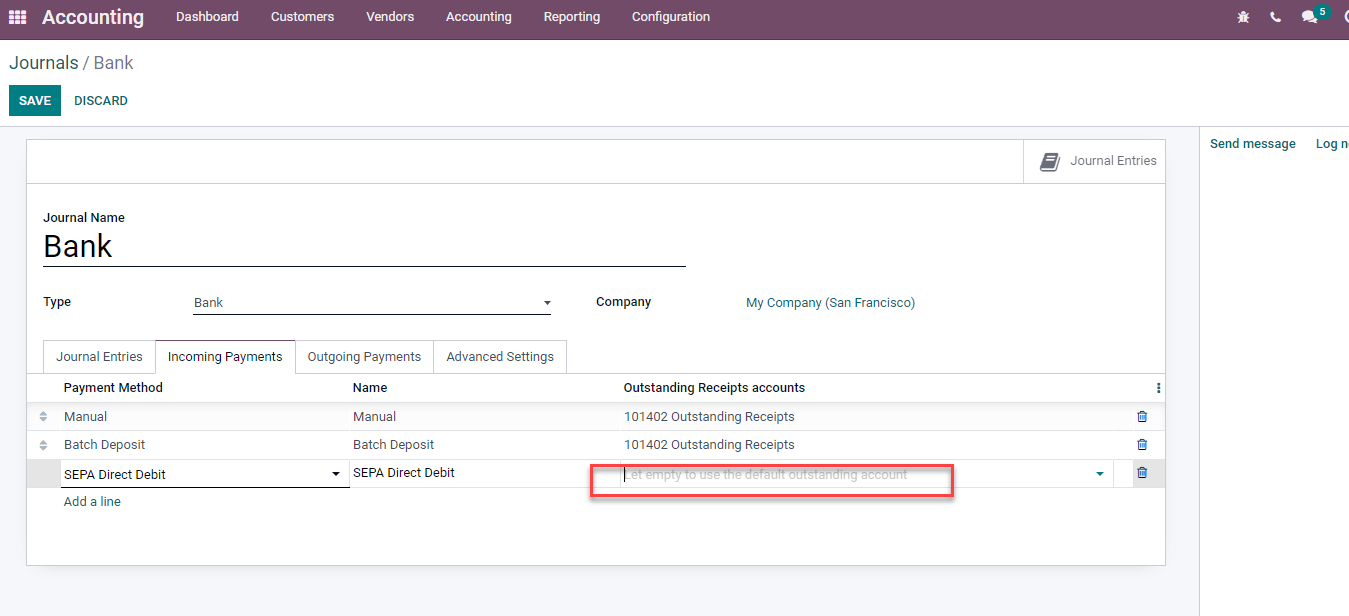

The Payment journal selected for your payment acquirer must be a Bank journal.

Accounting perspective¶

The Bank Payments that go directly to one of your bank accounts follow their usual reconciliation workflows. However, payments recorded with Online Payment Providers require you to consider how you want to record your payments’ journal entries. We recommend you to ask your accountant for advice.

You need to select a Payment Journal on your acquirer configuration to record the payments, on a Outstanding Account. The Journal’s type must be Bank Journal.

You can use a single journal for many payment methods. And for each payment method, you can either:

Define an Accounting Account to separate these payments from another payment method.

Leave blank to fallback on the default account, which you can see or change in the settings.

You can have the same bank account for the whole company, or for some journals only, or a single payment method… What best suit your needs.